Credit is a powerful thing. It has the power to give you all the things you want from life, like a new car, a house, or even that dream job you’ve always wanted. If your credit falls into disrepair, however, it also has the power to keep all of those financial milestones just out of your reach. Thankfully, there’s a solution: you can learn how to fix your credit.

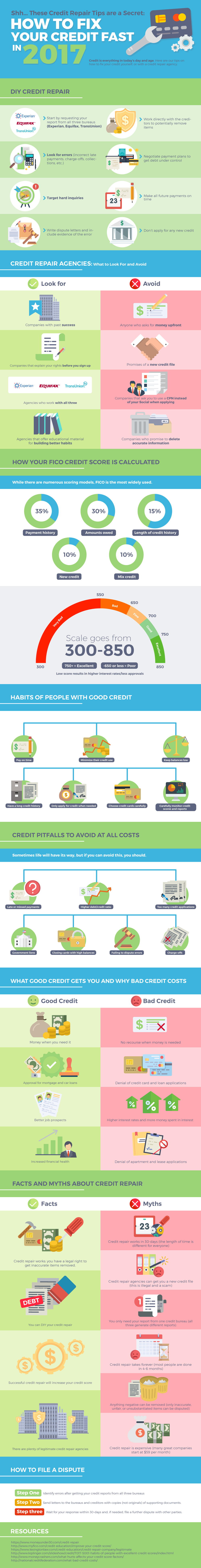

There are more effective strategies you can use to your advantage in getting a handle of your credit. Here’s an infographic that shares a few underused credit repair tips.

Plagued with bad credit? You’re in luck because in this simple guide I’m going to show you just how to fix bad credit fast and put yourself on the path to a better future and a financially stable lifestyle. We’ll start by looking at the credit system and what causes bad credit. Then we’ll look at the systems, laws, and companies that can help you with credit repair. It may seem like all hope is lost, but it’s not. We’re here to help.

How Can I Fix My Credit Score?

You have a lot of power when it comes to your credit. Of course, there are going to be things that are outside your control, but if you notice your score declining, you can start by focusing on paying your bills on time.

If you’re like me and you have trouble remembering all of the various due dates, you can set up alerts for yourself in a variety of ways. Or, if you have a consistent day you’d like to pay, many credit card companies will allow you to set up an auto-payment which will always ensure they are paid on time.

Tips to Get out of Debt

- Keep balances under 50% on all credit cards.

- Pay off all debt as soon as possible instead of allowing it to linger for months.

- Hold onto credit cards you don’t use to help raise your credit scores quickly.

- Pay at least twice the minimum payment required.

- Limit yourself to a maximum of three credits card.

If you miss a payment here or there, it’s not the end of the world. So long as you make the payment on time next month, your score won’t plummet. Then of course, we have the second most important factor: “utilization ratio.”

You should keep an eye on your balances. If you’re close to the limit, it can hurt your score more than help. Many credit advice says that you should limit your charges to 30% of the total limit or less. Now, some people will take this as a sign to use and immediately pay off their cards, but this is actually detrimental to building credit.

You should keep a balance running on your card and consistently make payments to build positive credit. If you’re constantly paying it off, you’re not earning anything towards your score. If you can’t qualify for a standard card, you can try looking at secured cards which utilize collateral to give you a credit for that amount (usually $500).

Next up, keep an eye on the number of accounts you have. If you have too many new accounts, it looks like you’re about to make some mistakes and that paints you as a risk to potential lenders. Don’t apply for credit cards in quick succession, and if you can help it, don’t sign up for store credit cards. These are worse for your credit than standard ones.

Finally, if you’re really in the low bracket, then it’s probably time to consider credit repair as an option.

How to Fix Bad Credit With Credit Restoration Services

There’s nothing more disheartening than getting a rejection when you’ve decided to make a major financial decision like your first credit card, mortgage, or even an apartment. You’ll usually get a letter that explains why you were rejected. It’s usually along the lines of too few accounts of a certain type, not enough revolving activity, or your score is simply too low.

This is where credit repair becomes a very viable option. It is possible to DIY credit repair, but it can be a daunting task for one person to take on. Instead, it makes more sense to get the help of experienced firms who know your rights and can maximize the opportunities to repair your credit.

So, how does credit repair work? It involves leveraging your rights as a consumer under several credit laws. As part of these laws, you are entitled to a report that is fair, substantiated, and accurate. Because credit reports come from three different bureaus, mistakes can happen.

If you have items on your report that aren’t correct or are outdated, they are weighing down your score. To fix this, you can dispute the incorrect elements and potentially have them removed, which will do wonders for your score over time.

How Long Will it Take to Repair and Fix My Credit?

Why should you go through with credit repair? Consider how long these mistakes will remain if you don’t fix them:

- Late payments – 7 years

- Foreclosures – 7 years

- Collections – 7 years

- Short sales – 7 years

- Bankruptcies – 10 years

- Repossessions – 7 years

- Judgments – 7 years after they’ve been paid

- Tax liens – 7 years after they are paid

- Charge-offs – 7 years after the account was charged off

Imagine what would happen if you could remove items that would otherwise drag you down for almost a decade? It would be a weight off your shoulders. Thankfully, you can. The laws in place require credit agencies to remove derogatory information after you’ve brought it to their attention within 30-days of the dispute.

This is much shorter than waiting years for it to go away on its own. A study done in 2012 by the Federal Trade Commission found that 79% of people who disputed an error on their credit reports had that error removed.

So, in short, credit repair companies can help you get these items removed. This will raise your score and essentially “repair” your credit. Let’s find out how it works.

How Do Companies Repair My Credit?

Credit repair services all take a similar approach to helping their clients. The biggest differentiators involve the price of their services, and how quickly they can pinpoint and file disputes. Of course, it’s also important to make sure they are legitimate companies as well.

There are, unfortunately, many companies that simply take your money and run. You can trust the services we recommend here on Debt Steps because we’ve vetted them thoroughly to ensure they are legitimate and have your best interests in mind.

Here’s the general process for credit repair:

1. Find What’s Dragging Your Score Down

The credit repair service you choose will have experienced professionals and attorneys on staff. Then will start by obtaining your credit reports from the three credit bureaus. Once they have them, they can begin looking at every element in great detail. You can also use this handy credit score estimator tool to calculate your score.

They have an eye for what could potentially be removed, so this process will be much faster if you have them on your side. They’ll look for the big factors like payment history, credit utilization, and so on.

Let’s say you have a negative mark for missing a payment, but you only missed it by a few hours. Perhaps you didn’t miss it at all? In either case, this could be a potential dispute that could end in your favor. With this late payment removed, you’re on the way to a better credit score. That brings us to step two

2. Dispute Items on Your Report

The second step simply involves going through the dispute process with the proper lenders or bureaus. This is where you’ll find that some credit repair companies work faster than others. Ultimately, you have options if you need help with your credit score.

Demystifying Credit Scores: What Causes Bad Credit?

Credit scores come from credit reports, so let’s start there. A credit report is a full compilation of all the borrowing you’ve done. Credit card companies and lenders use this report to see if you’re someone they trust to loan money or open up a card with.

John Ulzheimer, President of consumer education at CreditSesame.com says “The more of a risk you look like to the lender, the higher interest rate you’ll pay.” Interest rates are what keep you in debt, especially when they’re really high.

There are three main credit bureaus whose job it is to compile these reports:

- Equifax

- Experian

- TransUnion

These bureaus are sent regular reports from banks, credit card companies, and other data furnishers. They take information like late payments, missed payments, credit limit ratios, and other data and place it on your credit report.

For each of your accounts, this report will show the date it was opened, how much you were given, or what limit you have, and payment history. This report also tracks and shows “inquiries” that show every time you applied for a loan or credit card. It can also have court judgments, information on your bills, collections, tax liens, and other negative information.

Negative items on your report will stick around anywhere between 7-10 years before they are removed. These are gigantic red flags for loaners or creditors. It could result in you getting denied, or stuck with a higher interest rate.

On the flip-side, positive information sticks around permanently. You can get a free credit report from each of the bureaus once per year at annualcreditreport.com. Why three reports, I hear you asking? All of the bureaus get their data on you from different sources.

In most cases, the reports are identical, but in some cases, they’re not. In these situations, you may have duplicate or inaccurate information dragging you down. If anyone is trying something fishy with your identity, you’ll be able to catch it early on these reports as well.

It’s always important to check these, especially if you’re about to apply for a mortgage or a loan to buy a car. So, now that we’ve established credit reports, let’s move on to your credit score.

How is My Credit Score Calculated?

Your credit report is just a factual look at your history, but your credit score is kind of like your GPA in school. It shows how well you handle credit and financial responsibility compared to others. Lenders assign their interest rates based on the bracket your score falls into.

While banks have primarily used them, scores have quickly become something that insurance firms, landlord, and even some employers now look at when making a decision. Your credit score is essentially being used to decide how responsible and reliable you are as a person. A bit of a stretch? Sure, but it is what it is.

So, if everyone’s using it, then credit scores are more important than ever. Unfortunately, like most things with credit, there isn’t a single standard here. The most popular scoring system is known as FICO. This one ranges from 300-8500.

With this scale, higher is better. If you have over 740, your score is considered “excellent” and you’ll be rolling in the low rates. If you’re below 650, the opposite is true. The crazy part is that even something as small as ten points can make a big difference. Someone with a score of 659 may get a 5.8% interest rate on a loan, while someone with 680 as their score could get 4.7%.

It may not seem like much, but this adds up to hundreds of dollars per year that you could be saving in interest alone. The creators of the FICO score, Fair Isaac, don’t tell people how the score is calculated, but they have offered some breakdowns on how it’s built:

- 35% payment history

- 30% amount owed

- 15% length of history

- 10% new credit

- 10% types of credit used

As you can see, your payment history is the most important factor in determining your score. This is a look at how often you’ve paid your bills on time. Moving on to the second factor, the amount owed is the ratio of how much credit you’re using to what you have available. This is called your “utilization ratio.”

It’s generally believed that borrowers who are close to their limit are more likely to miss payments, so that’s why general advice is to keep your balances low. Moving on, the third factor is decided based on the average age of your accounts on the report. Opening a lot of accounts can hurt your score by dragging this average down.

The last factor looks at the types of credit you have. This can be cards, loans, or mortgages. Having a variety of items on your report can show that you’re good at managing multiple types of credit, which lenders like to see.